Read Also: Taxpayer’s remedies against assessment and collection by BIR

Sales invoice is issued as a principal evidence in the sale of goods and/or properties while official receipt is issued as principal evidence in the sale of services and/or lease of properties.

The Tax Code provides that a VAT-registered person shall issue:

(1) A VAT invoice for every sale, barter or exchange of goods or properties; and

(2) A VAT official receipt for every lease of goods or properties, and for every sale, barter or exchange of services.

Although the law is clear, many were still confused on the use of the said documents. For this reason, Bureau of Internal Revenue (BIR) reiterated the matter through Revenue Memorandum Circular No. 002-14, which states that:

- Sales Invoice (Cash or Charge) shall be issued as Principal evidence in the sale of goods and/or properties;

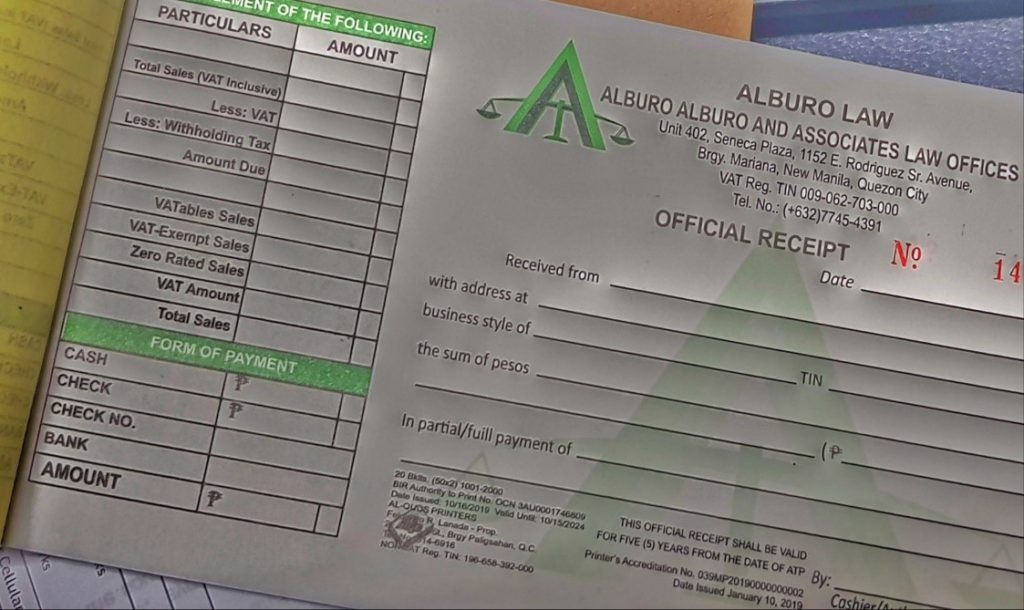

- Official Receipt shall be issued as Principal evidence in the sale of services and/or lease of properties; and

- Commercial Receipts/Invoices such as delivery receipts, order slips, purchase orders, provisional receipts, acknowledgment receipts, collection receipts, credit/debit memo, job orders and other similar documents that form part of the accounting records of the taxpayer and/or issued to their customers evidencing delivery, agreement to sell or transfer of goods and services, shall be Supplementary evidence only.

Based on the foregoing, the sales invoice shall serve in lieu of Official Receipt in the sale of goods or properties for evidentiary purposes in terms of audit. And official receipts (OR) shall be used as proof only for sale of services. BIR further required its strict observance.

What happens if one interchanged the use of sales invoice and official receipt?

In the case, Kepco Philippines Corp. v. Commissioner of Internal Revenue, Kepco interchanged the use of sales invoice and official receipts for purpose of substantiating its input VAT. And for its failure to follow the invoicing requirement, the Court disallowed it claim of input tax.

Accordingly, the invoicing and substantiation requirements must be strictly followed because it isthe only way to determine the veracity of taxpayer’s claims.

Thus, for the purchase of goods, request for Sales Invoice, not

OR.

Alburo Alburo and Associates Law Offices specializes in business law and labor law consulting. For inquiries, you may reach us at info@alburolaw.com, or dial us at (02)7745-4391/0917-5772207.

All rights reserved.

SUBSCRIBE NOW FOR MORE LEGAL UPDATES!

[email-subscribers-form id=”4″]

You got a very excellent wеbsite, Glad I detected it through үahoo.

It is really a great and helpful piece of info. I am glad that you shared this useful info with us. Please keep us informed like this. Thank you for sharing.

Yoou got a very wonderful ԝebsіte, Sword lily I discovered it througһ yahoo.

There is noticeably a bundle to learn about this. I assume you made sure nice factors in options also.

Love it

Great blog, I am going to spend more time reading about this subject

Magnificent goods from you, man. I’ve understand your stuff previous to and you’re just extremely fantastic. I really like what you have acquired here, certainly like what you’re stating and the way in which you say it. You make it entertaining and you still take care of to keep it wise. I can not wait to read far more from you. This is actually a terrific web site.

Thanks for another informative blog. Where else could I get that kind of information written in such a perfect way? I’ve a project that I am just now working on, and I have been on the look out for such info.

Really Appreciate this article, how can I make is so that I receive an update sent in an email when you write a new article?

you are really a good webmaster. The site loading speed is incredible. It seems that you’re doing any unique trick. In addition, The contents are masterpiece. you’ve done a great job on this topic!