Read Also: Taxpayer’s remedies against assessment and collection by BIR

Sales invoice is issued as a principal evidence in the sale of goods and/or properties while official receipt is issued as principal evidence in the sale of services and/or lease of properties.

The Tax Code provides that a VAT-registered person shall issue:

(1) A VAT invoice for every sale, barter or exchange of goods or properties; and

(2) A VAT official receipt for every lease of goods or properties, and for every sale, barter or exchange of services.

Although the law is clear, many were still confused on the use of the said documents. For this reason, Bureau of Internal Revenue (BIR) reiterated the matter through Revenue Memorandum Circular No. 002-14, which states that:

- Sales Invoice (Cash or Charge) shall be issued as Principal evidence in the sale of goods and/or properties;

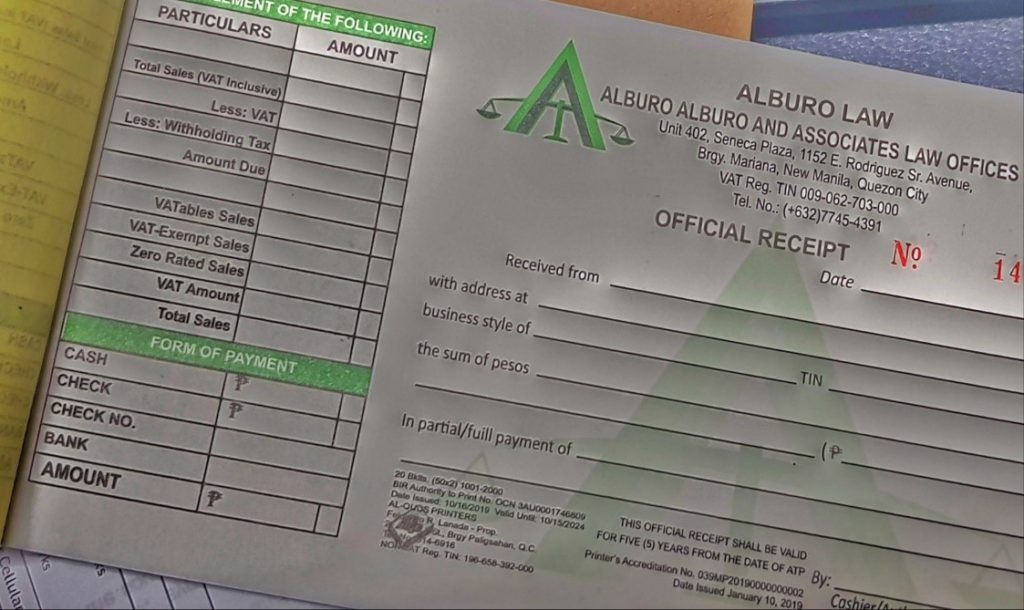

- Official Receipt shall be issued as Principal evidence in the sale of services and/or lease of properties; and

- Commercial Receipts/Invoices such as delivery receipts, order slips, purchase orders, provisional receipts, acknowledgment receipts, collection receipts, credit/debit memo, job orders and other similar documents that form part of the accounting records of the taxpayer and/or issued to their customers evidencing delivery, agreement to sell or transfer of goods and services, shall be Supplementary evidence only.

Based on the foregoing, the sales invoice shall serve in lieu of Official Receipt in the sale of goods or properties for evidentiary purposes in terms of audit. And official receipts (OR) shall be used as proof only for sale of services. BIR further required its strict observance.

What happens if one interchanged the use of sales invoice and official receipt?

In the case, Kepco Philippines Corp. v. Commissioner of Internal Revenue, Kepco interchanged the use of sales invoice and official receipts for purpose of substantiating its input VAT. And for its failure to follow the invoicing requirement, the Court disallowed it claim of input tax.

Accordingly, the invoicing and substantiation requirements must be strictly followed because it isthe only way to determine the veracity of taxpayer’s claims.

Thus, for the purchase of goods, request for Sales Invoice, not

OR.

Alburo Alburo and Associates Law Offices specializes in business law and labor law consulting. For inquiries, you may reach us at info@alburolaw.com, or dial us at (02)7745-4391/0917-5772207.

All rights reserved.

SUBSCRIBE NOW FOR MORE LEGAL UPDATES!

[email-subscribers-form id=”4″]

I loved as much as you’ll receive carried out right here. The sketch is tasteful, your authored subject matter stylish. nonetheless, you command get got an impatience over that you wish be delivering the following. unwell unquestionably come further formerly again since exactly the same nearly a lot often inside case you shield this increase.

wonderful post, very informative. I ponder why the other specialists of this sector don’t notice this. You must proceed your writing. I’m sure, you have a huge readers’ base already!

Thank you this good info for me

This design is steller! You obviously know how to keep a reader entertained. Between your wit and your videos, I was almost moved to start my own blog (well, almost…HaHa!) Fantastic job. I really enjoyed what you had to say, and more than that, how you presented it. Too cool!

Answer some Thanks

I really appreciate this post. I have been looking all over for this! Thank goodness I found it on Bing. You’ve made my day! Thx again

Hi my friend! I want to say that this post is awesome, nice written and include almost all significant infos. I like to see more posts like this.

Hey would you mind letting me know which web host you’re utilizing? I’ve loaded your blog in 3 completely different web browsers and I must say this blog loads a lot faster then most. Can you recommend a good web hosting provider at a honest price? Kudos, I appreciate it!

I was pretty pleased to discover this page. I want to to thank you for ones time for this particularly wonderful read!! I definitely liked every little bit of it and i also have you saved to fav to look at new stuff in your site.

As I web site possessor I believe the content material here is rattling magnificent , appreciate it for your hard work. You should keep it up forever! Best of luck.