More on ANTI-MONEY LAUNDERING ACT: ON COVERED INSTITUTIONS UNDER ANTI-MONEY LAUNDERING ACT

-

A transaction in cash or other equivalent monetary instrument may be the subject of an investigation

-

Said transaction must involve a total amount in excess of Five Hundred Thousand Pesos (Php 500,000.00) within one (1) banking day

-

However, if the transaction is suspicious, it may still be subjected to an investigation regardless of the amount involved

Money doesn’t change men; it merely unmasks them. – Henry Ford

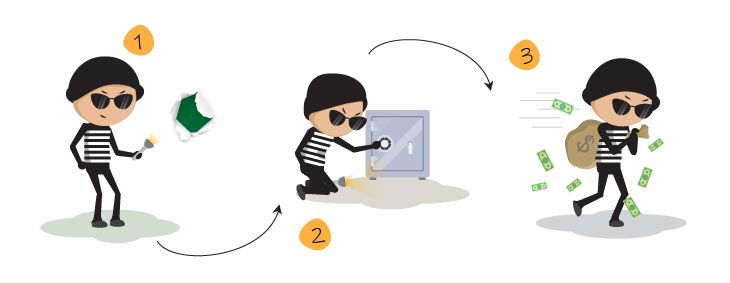

In our previous article, covered institutions are mandated to report to the Anti-Money Laundering Council (AMLC) all covered transactions.

Under the Revised Implementing Rules and Regulations of the Anti-Money Laundering Act as amended, “transaction” refers to any act establishing any right or obligation or giving rise to any contractual or legal relationship between the parties. It also includes any movement of funds by any means with a covered institution.

What is a covered transaction?

The law says:

Under the old law, covered transaction is a single, series, or combination of transactions involving a total amount in excess of Four Million Philippine Pesos (Php 4,000,000.00) or an equivalent amount in foreign currency based on the prevailing exchange rate within five (5) consecutive banking days except those between a covered institution and a person who, at the time the transaction was a properly identified client and the amount is commensurate with the business of financial capacity of the client; or those with an underlying legal or trade obligation, purpose, origin or economic justification.

However, under its amendment, covered transaction is a transaction in cash or other equivalent monetary instrument involving a total amount in excess of Five Hundred Thousand Pesos (Php 500,000.00) within one (1) banking day. In other words, the amendment significantly lowered the amount of money and the number of banking day.

Do note that if the transaction is suspicious, covered institutions are still mandated to report the same for the purpose of investigation.

What is a suspicious transaction?

The law says:

Suspicious transaction is a transaction with covered institutions, regardless of the amounts involved where any of the following circumstances exist:

- there is no underlying legal or trade obligation, purpose or economic justification;

- the client is not properly identified;

- the amount involved is not commensurate with the business or financial capacity of the client;

- taking into account all known circumstances, it may be perceived that the client’s transaction is structured in order to avoid being the subject of reporting requirements under the law;

- any circumstances relating to the transaction which is observed to deviate from the profile of the client and/or the client’s past transactions with the covered institution;

- the transaction is in a way related to an unlawful activity or offense under the Anti-Money Laundering Act that is about to be, is being or has been committed; or

- any transactions that is similar or analogous to any of the foregoing.

Alburo Alburo and Associates Law Offices specializes in business law and labor law consulting. For inquiries, you may reach us at info@alburolaw.com, or dial us at (02)7745-4391/0917-5772207.

All rights reserved.

SUBSCRIBE NOW FOR MORE LEGAL UPDATES!

[email-subscribers-form id=”4″]