Published — June 1, 2022

The following post does not create a lawyer-client relationship between Alburo Alburo and Associates Law Offices (or any of its lawyers) and the reader. It is still best for you to engage the services of your own lawyer to address your legal concerns, if any.

Also, the matters contained in the following were written in accordance with the law, rules, and jurisprudence prevailing at the time of writing and posting, and do not include any future developments on the subject matter under discussion.

Read also: SALES INVOICE or OFFICIAL RECEIPT?

In relation to Proclamation No. 929, s. 2020 imposing the Enhanced Community Quarantine (ECQ) on March 16, 2020 over Luzon and Republic Act No. 11469 otherwise known as “Bayanihan to Heal As One Act”, the Bureau of Internal Revenue issued RMO Circular 41-2020 on 8 April 2020 to clarify the time of application for new Authority to Print (ATP) Receipts/Invoices of taxpayers with expiring principal and supplementary receipts/invoices and to extend the required period such application.

Relative thereto, the filing of application for new ATP for expiring principal and supplementary receipts/invoices where the expiration date(s) falls within the period of the ECQ, was extended until May 13, 2020 or for thirty (30) calendar days after the lifting of the ECQ (if extended), whichever comes later, without imposition of the penalties to the taxpayer. Further, the use of expired principal and supplementary receipts/invoices that falls within the period of the ECQ, was extended until May 13, 2020 or 30-calendar days after the lifting of the ECQ (if extended), whichever comes later, provided, that:

- Taxpayer cannot apply for new ATP due to the ECQ or the application has been filed and received by the Bureau but the accredited printer cannot deliver the receipts/invoices to the concerned taxpayer due to the ECQ; and,

- Said receipts/invoices to be issued/used shall be stamped “Emergency Extension for Use until May 13, 2020” (if the ECQ is extended, the date shall be 30 days after the last day of ECQ,).

In addition, to address the difficulty for business entities to issue receipts or invoices brought about by ECQ, Bureau of Internal Revenue (BIR) issued RMO 47-2020 on 11 May 2020 which allowed business taxpayers opt to use any of the following:

- Bureau of Internal Revenue (BIR) Printed Receipts/Invoices;

- Scanned Copy of Receipt/Invoice with ATP electronically transmitted to the customer;

- Computer-aided Receipt/Invoice in Excel format not covered by an ATP and electronically transmitted to the customer;

- Supplementary Receipts/Invoices (i.e., Delivery Receipts, Acknowledgment Receipts, etc.) in lieu of Principal Receipts/Invoices;

- Receipt/Invoice using the existing Computerized Accounting System (CAS) or its components with approved PTU or Acknowledgement Certificate sent electronically or via e-mail to the customer; and

- Receipt/Invoice generated from newly developed receipting/invoicing software or CAS or its Components without duly approved PTU or Acknowledgment Certificate, which was used to temporarily generate/issue the receipts/invoices and sent electronically to the customer.

Any taxpayer who adopted any of the cases/work-around procedures enumerated above in order to continue its business operation shall be allowed to do so provided that the following guidelines and procedures has been observed:

- A formal-letter was submitted to inform the Bureau on the workaround procedures being implemented by business taxpayers on the issuance of its receipts/invoices, within three (3) days from the effectivity of the Circular or until 14 May 2020, indicating following information:

- Name of the taxpayer,

- Registered Address of the Taxpayer;

- Taxpayer Identification Number (TIN) with Branch Code;

- Temporary measures to be used/being used on the issuance of receipts/invoices during the implementation of the ECQ, indicating the serial numbers of the said receipts/invoices that will be issued;

- Statement that taxpayer is amenable to a post-verification of the reported sales during the period covered whenever the Commissioner so orders; and

- Signature of taxpayer or its authorized representative and designation. The letter must have been sent to the following email address:

- FOR NON LARGE TAXPAYERS: Client Support Service (CSS), Attention: Taxpayer Service Programs and Monitoring Division (TSPMD) at elenita.mariano@bir.gov.ph (for Regular Taxpayers);

- FOR LARGE TAXPAYERS: Large Тахрауers Assistance Division (LTAD) at mildred.reyes@bir.gov.ph (for large taxpayers registered under RDO 116, 125 and 126);

- Once the ECQ has been lifted, the taxpayer/seller must immediately provide or issue the duly authorized receipts/invoices, to their clients/customers to cover all sales transactions that were issued temporary receipts/invoices during the implementation of ECQ. These temporary receipts/invoices should be prioritized in the issuance of authorized receipts/invoices over the current transactions. The actual date of transaction must be indicated in the authorized manual receipts/invoices to be issued and a copy of the temporary receipt/invoice attached to the file copy for audit purposes.

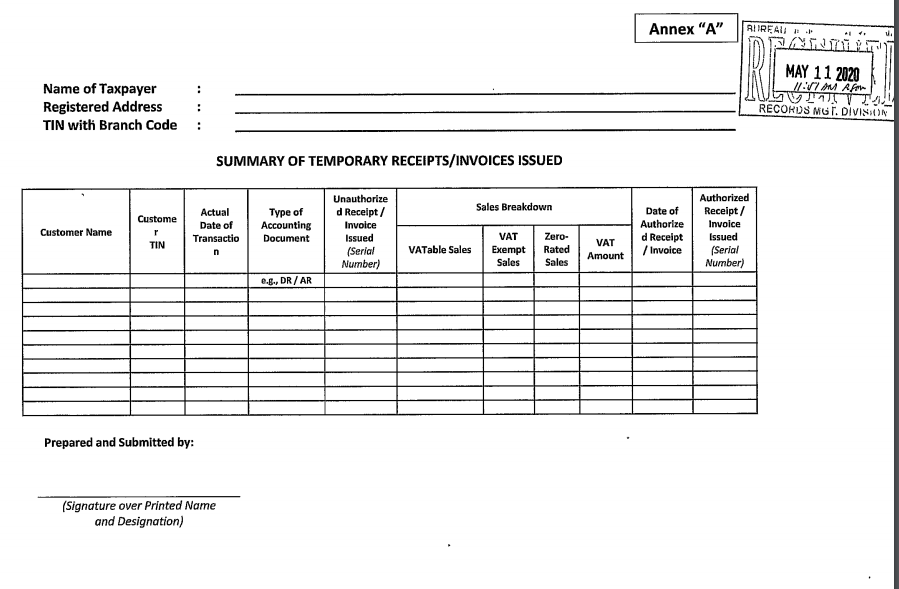

- A Summary of Temporary Receipts/Invoices Issued must be submitted to the respective BIR Offices stated in Item No. 1 above within ninety (90) days from the date of the lifting of the ECQ, following format below.

Excise Large Taxpayers Regulatory Division (ELTRD) at ma.rosario.puno@bir.gov.ph (for Excise LTs registered under RDO 121 and 124);LT District Office Cebu at edenny.lingan@bir.gov.ph (for LTs registered under RDO 123); and

LT District Office Davao at emiliano.singco@bir.gov.ph and/or rdo_127@bir.gov.ph (for LTs registered under RDO 127).

For those taxpayers/sellers using receipting/invoicing system or CAS where such system automatically indicates the date of the transaction, i.e. date generated, on the authorized system-generated receipt/invoice, the actual date of transaction should appear on the face of such system generated receipts/invoices in any manner feasible. Consequently, such receipts/invoices shall not be considered “out of period” receipts/invoices as these were issued during the EGQ through the temporary measures implemented by the taxpayer.

Alburo Alburo and Associates Law Offices specializes in business law and labor law consulting. For inquiries, you may reach us at info@alburolaw.com, or dial us at (02)7745-4391/0917-5772207.

All rights reserved.

SUBSCRIBE NOW FOR MORE LEGAL UPDATES!

[email-subscribers-form id=”4″]