Photo from Pexels | Ramaz

This article was originally published on March 19, 2019 and has been updated to reflect recent legal developments.

The following post does not create a lawyer-client relationship between Alburo Alburo and Associates Law Offices (or any of its lawyers) and the reader. It is still best for you to engage the services of a lawyer or you may directly contact and consult Alburo Alburo and Associates Law Offices to address your specific legal concerns, if there is any.

Also, the matters contained in the following were written in accordance with the law, rules, and jurisprudence prevailing at the time of writing and posting, and do not include any future developments on the subject matter under discussion.

AT A GLANCE:

Among the laws enacted in year 2017 was Republic Act. No. 10963 or the Tax Reform for Acceleration and Inclusion (TRAIN) Act. TRAIN Law aims to make the tax system simpler, fairer, and more efficient. Further, it seeks to address several weaknesses of the old tax system by lowering and simplifying personal income taxes, simplifying estate and donor’s taxes, expanding the value-added tax (VAT) base, adjusting oil and automobile excise taxes, and introducing excise tax on sugar-sweetened beverages (What is the COMPREHENSIVE TAX REFORM). If continuously implemented, TRAIN Law may be employed to accelerate poverty reduction. In view of this, we welcome the passage of the Republic Act. No. 11213 or the Tax Amnesty Act. The law is meant to complement TRAIN Law. With the Tax Amnesty Act, taxpayers will be given the opportunity to settle outstanding tax liabilities, particularly those long idle estate properties and move forward and spur economic growth in the Philippines.

Moving Forward through Tax Amnesty Law

Tax amnesty is a measure that condones the liabilities incurred by a taxpayer due to his incorrect or non-payment of taxes on condition that the taxpayer complies with certain requirements (Q&A Tax Amnesty No. 2004-04). There are various justifications on the offering of Tax Amnesty, it includes but not limited to, immediate and sufficient collection of tax to finance government infrastructures, projects and other obligations, reduce, cleanse and organize the database of the government for more efficient administrative functions.

The justification for the implementation of R.A. No. 11213 is to protect and enhance revenue administration and collection, and make our country’s tax system more equitable. To achieve all these, the said tax amnesty act provides a one-time opportunity to settle estate tax obligations through programs that will give reasonable tax relief to estate with deficiency estate taxes, enhance revenue collection by providing a tax amnesty on delinquencies that will minimize administrative costs in pursuing tax cases and declog the dockets of the Bureau of Internal Revenue (BIR) and the courts and provide a more equitable tax system by adopting a comprehensive tax reform program that will simplify the requirements on tax amnesties with the use of simplified forms, and utilization of information technology in broadening the tax base (Section 2, RA 11213).

Availment of Estate Tax Amnesty

A tax amnesty is granted to those estate of decedents who died on or before December 31, 2017, with or without assessments duly issued therefor, whose estate taxes have remained unpaid or have accrued as of December 31, 2017 (Sec. 4, RA 11213). However, the said estate tax amnesty shall not extend to estate tax cases which shall have become final and executory and to properties involved in cases pending in appropriate courts, these cases are:

- Falling under the jurisdiction of the Presidential Commission on Good Governance;

- Involving unexplained or unlawfully acquired wealth under Republic Act No. 3019, otherwise known as the Anti-Graft and Corrupt Practices Act, and Republic Act No. 7080 or an Act Defining and Penalizing the Crime of Plunder;

- Involving tax evasion and other criminal offenses under Chapter 2 of Title 10 of the National Internal Revenue Code of 1997, as amended; and

- Involving felonies of frauds, illegal exactions and transactions and malversation of public funds and property under Chapters 3 and 4 of Title 7 of the Revised Penal Code. (Sec. 9, RA 11213)

The immunities and privileges granted by the Estate Tax Amnesty, if the requirements were fully complied with, are immunity from payment from all estate taxes including any increments and additions thereto, arising from failure to pay any and all estate taxes for taxable year 2017 and prior years, and from all appurtenant civil, criminal and administrative cases and penalties under the NIRC of 1997 (Sec. 8, RA 11213).

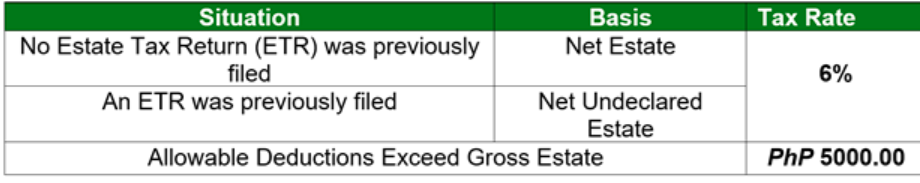

Estate Tax Amnesty requires payment of an estate tax amnesty (ETA) at the rate of six percent (6%) based on the decedent’s total net estate at the time of death, provided, that if an estate tax return was previously filed with the BIR, the estate tax rate of 6% shall be based on net undeclared estate. However, if the allowable deductions applicable at the time of death of the decedent exceed the value of the gross estate, the heirs, executors or administrators may avail of the benefits of tax amnesty under this act, and pay the minimum estate tax amnesty of Five Thousand Pesos (P5,000.00). (Sec. 5, RA 11213)

The computation of gross and net estate tax shall be governed suppletorily by the Tax Code prevailing at the time of death.

The schedule of rates of payment and its basis are summarized by the table below:

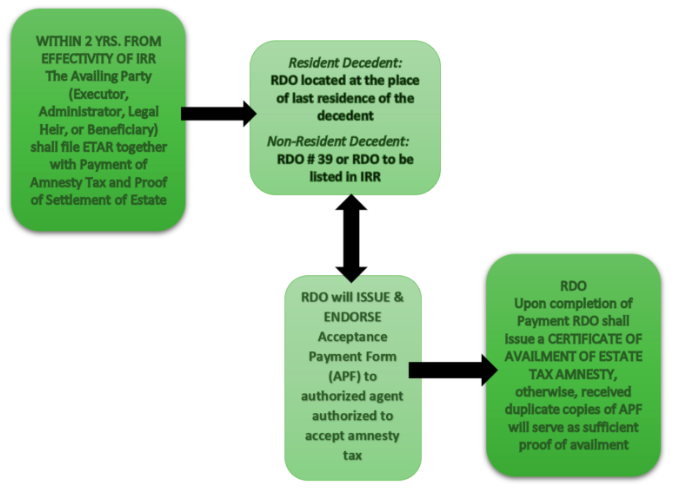

In order to avail of Estate Tax Amnesty, the executor or administrator of the estate, or in the absence thereof, the legal heirs, transferees or beneficiaries, who wish to avail of the Estate Tax Amnesty shall, within two (2) years from the effectivity of the Implementing Rules and Regulations (IRR) of this Act shall, file a sworn Estate Tax Amnesty Return (ETAR) with the Revenue District Office (RDO) of BIR which has jurisdiction over the last residence of the decedent. In case of non-resident decedents, the ETAR shall be filed and paid at RDO No. 39, or any RDO indicated in the IRR. The amnesty payment and proof of settlement of estate of the decedent, whether judicial or extrajudicial, shall be attached with the ETAR in order to verify the mode of transfer and the proper recipients.

Republic Act No. 11569 provides that the executor or administrator of the estate, of if there is no executor or administrator appointed, the legal heirs, transferees or beneficiaries, who wish to avail of the Estate Tax Amnesty shall, within June 15, 2021 until June 24, 2023, file with the Revenue District Office of the BIR, which has jurisdiction over the last residence of the decedent a sworn Estate Tax Amnesty Return, in such forms as may be prescribed in the Implementing Rules and Regulations. The payment of the tax amnesty shall be made at the time the Return is filed: Provided, that for nonresident decedents, the Estate Tax Amnesty Return shall be filed and the corresponding amnesty tax be paid at Revenue District Office No. 39, or any other Revenue District Office which shall be indicated in the Implementing Rules and Regulations;

Provided, further, That the appropriate Revenue District Office shall issue and endorse an acceptance payment form, in such form as may be prescribed in the Implementing Rules and Regulations of this Act for the authorized agent bank, or in the absence thereof, the revenue collection agent or municipal treasurer concerned, to accept the tax amnesty payment;

Provided, finally, That the availment of the Estate Tax Amnesty and the issuance of the corresponding Acceptance Payment Form do not imply any admission of criminal, civil or administrative liability on the part of the availing estate.

The APF and ETAR shall be submitted to RDO after complete payment. And finally, the completion of these requirements shall be deemed full compliance with the provisions of this Act. A Certificate of Availment of the Estate Tax Amnesty shall be issued by the BIR within fifteen (15) days from submission to the BIR of the APF and ETAR. Otherwise, the duplicate copies of the APF, stamped as received, and the ETAR shall be deemed as sufficient proof of availment. (Sec. 7, RA 11213)

A summary of the said procedure is summarized by the graph below:

Tax Amnesty on Delinquencies

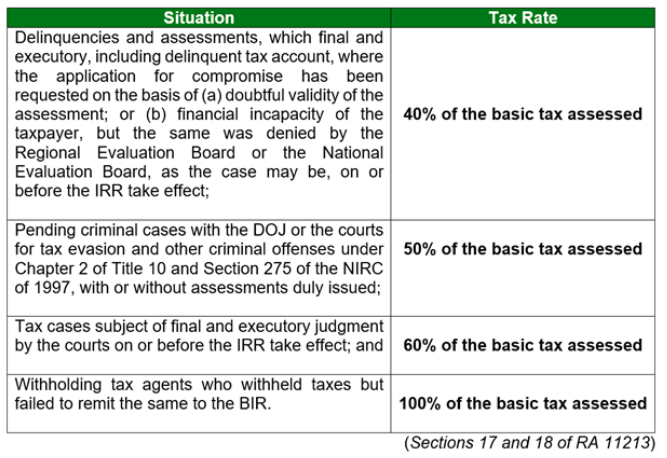

Aside from Estate Tax Amnesty, RA 11213 also grants Tax Amnesty on Delinquencies which shall cover all national internal revenue taxes such as, but not limited to, income tax, withholding tax, capital gains tax, donor’s tax, value-added tax (VAT), other percentage taxes, excise tax and documentary stamp tax collected by the BIR, including VAT and excise taxes collected by the Bureau of Customs (BOC) for taxable year 2017 and prior years. Upon payment of amnesty tax, privileges include, termination of criminal, civil or administrative cases involving such tax delinquencies and immunity from all suits or actions arising from the taxes subject of the tax amnesty (Sec. 20 of RA 11213).

Particularly, Tax Amnesties on Delinquencies may be availed of in the following instances. The schedule of tax rates on the basis of the said instances are also summarized by the table below:

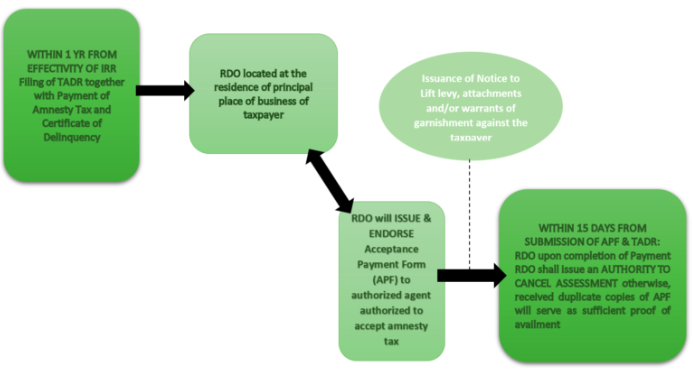

Any person, natural or juridical, who wishes to avail of the Tax Amnesty on Delinquencies shall, within one (1) year from the effectivity of the IRR of this Act, file with the appropriate RDO, which has jurisdiction over the residence or principal place of business of the taxpayer, a sworn Tax Amnesty Delinquencies Return (TADR) accompanied by a Certificate of Delinquency and payment of the amnesty tax. Subsequently, RDO shall issue and endorse an Acceptance Payment Form (APF), in such form as may be prescribed in the IRR for the authorized agent bank, or revenue collection agent or municipal treasurer concerned, to accept the amnesty payment. (Sec. 19 of RA 11213)

Other remedies are also made available to persons availing of Tax Amnesty on Delinquencies, such remedies include but not limited to, lifting of notices of levy, attachments and/or warrants of garnishment.

An Authority to Cancel Assessment shall be issued by the BIR in favor of the taxpayer availing of the Tax Amnesty on Delinquencies within fifteen (15) days from submission to the BIR of the APF and TADR. Otherwise, the duplicate copies, stamped as received, of the APF and TADR shall be sufficient proof of availment. (Sec. 20 of RA 11213)

A summary of the said procedure is summarized by the graph below:

Related Articles:

- Prohibition on Compensation and Set-Off of Taxes

- Assessment for deficiency taxes: Is it a pre-requisite for collection of the taxpayer-accused’s civil liability for unpaid taxes?

Click here to subscribe to our newsletter

Alburo Alburo and Associates Law Offices specializes in business law and labor law consulting. For inquiries regarding legal services, you may reach us at info@alburolaw.com, or dial us at (02)7745-4391/ 09175772207/ 09778050020.

All rights reserved.